Industry News

-

30

2018-07

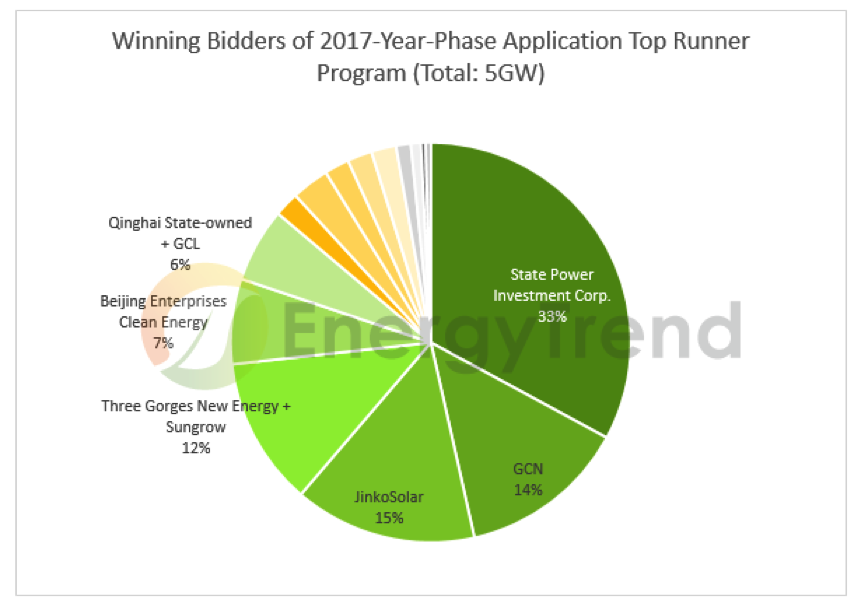

The 2017-year-phase Application Top Runner Program's auction were completed. According to EnergyTrend's compilation of the bidding results, mono-Si took the most shares, and bifacial technology occupied more than 50%. The bifacial technology will accelerate its commercialization process because of the Application Top Runner Program. Meanwhile, the total percentage of successful bidding projects by state-owned enterprises amounted to above 80%. The state-owned companies are apparently leading the technology advancement. -

30

2018-07

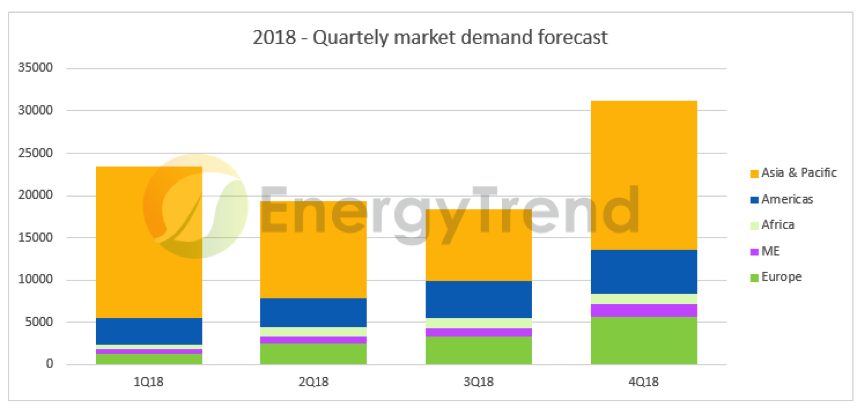

According to the latest research of EnergyTrend, a division of TrendForce, Chinese domestic solar market has been shirking after the release of new PV policy. Faced with the oversupply, Chinese module makers will seek ways to export the excessive products, or even sell off the products to overseas markets. Therefore, the global solar industry has paid intense attention to the price trends of modules and when EPC companies would place orders. -

30

2018-07

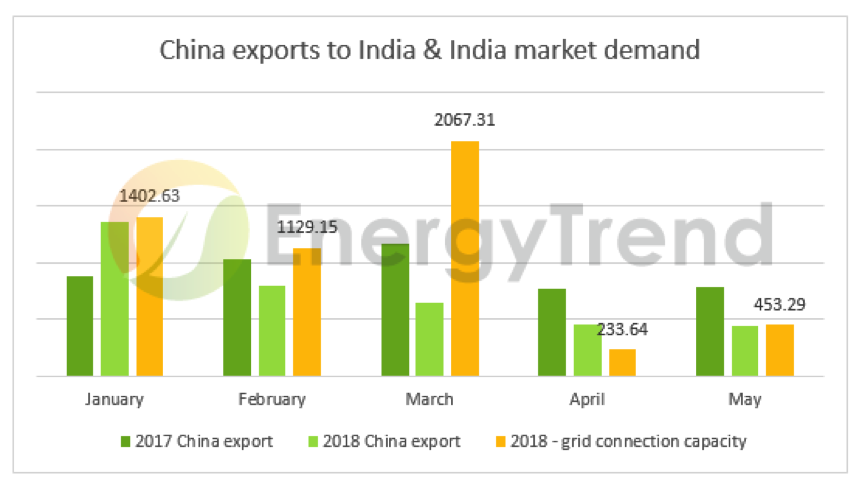

India may levy up to 25% tariff on imported PV cells and modules, according to the investigative report on safeguard measures released by India's Directorate General of Trade Remedies (DGTR). In the short term, the proposal will have a noticeable impact on the market’s price quotes, but its impact on the country’s overall market status will be limited, as the tariff’s impact will still hinge on the change of Europe’s trade barriers against China. -

30

2018-07

A notification released on May 31st 2018 by China’s National Development and Reform Commission (NDRC), Ministry of Finance, and National Energy Administration (NEA) provides new regulation for PV industry in China, which may influence various types of PV projects. EnergyTrend estimates that the new regulation will likely slash the domestic PV demand in China to 29~35GW. Consequently, the demand in global PV industry will drop to less than 100GW, imposing considerable pressure to the supply chain. -

30

2018-07

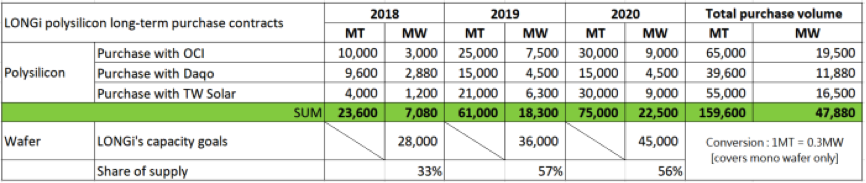

LONGi, China's leading mono-si supplier, has targeted expanding its mono-si wafer capacities significantly in the next three years, reaching 28 GW in 2018, 36 GW in 2019, and 45 GW in 2020, according to its three-year strategic plan (2018-2020), unveiled in January this year. In order to secure polysilicon supply which is essential for attaining the goals, LONGi has inked long-term contracts for polysilicon materials with TW Solar’s subsidiary company Yongxiang, Daqo New Energy, and OCI of Korea this year.

15553

15553